Navigating the Transformation: A Strategic C-Suite Guide to RISE with SAP

Executive Summary

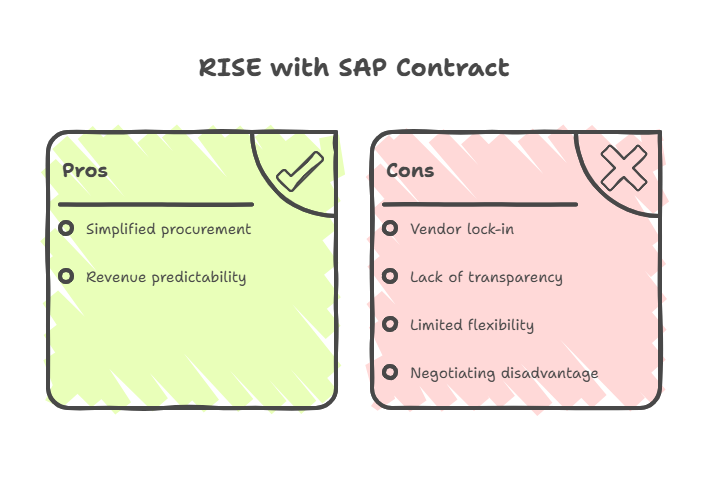

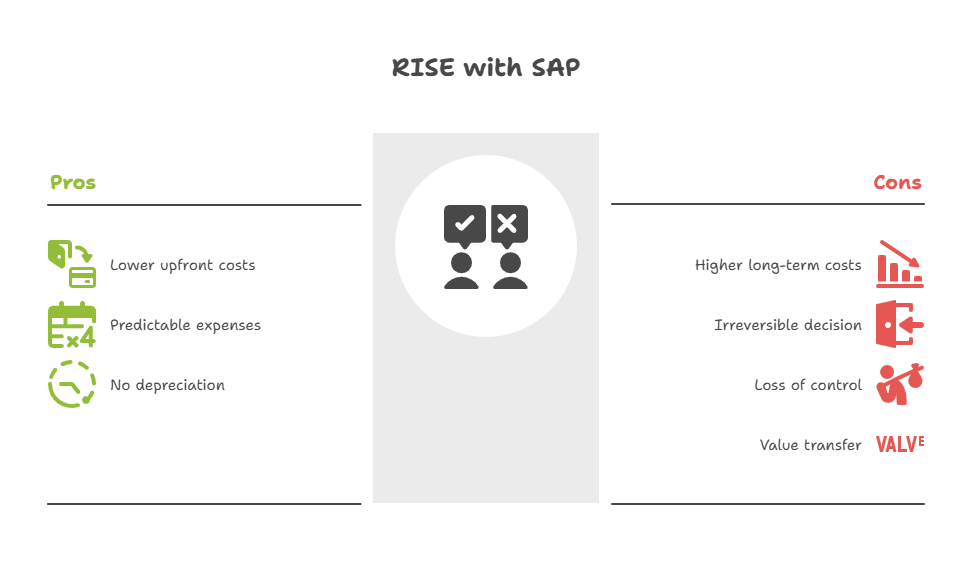

RISE with SAP represents the company’s most ambitious strategic pivot to date, repackaging its flagship S/4HANA ERP, cloud infrastructure, and a suite of transformation services into a single, subscription-based offering. Marketed as “Business Transformation as a Service” (BTaaS), it presents a compelling proposition of simplification: one contract, one point of accountability, and a guided journey to the cloud-native Intelligent Enterprise. For organizations burdened by complex legacy landscapes and vendor management overhead, the appeal is undeniable. It promises to accelerate innovation and reduce the total cost of ownership (TCO) by offloading technical management to SAP, thereby freeing internal resources to focus on strategic, value-added activities.

However, a detailed analysis reveals that this surface-level simplicity masks a new layer of profound complexity and significant strategic risk. The shift from perpetual software ownership to a mandatory subscription model fundamentally alters the customer-vendor relationship, trading a capital asset for a recurring operational liability. This report provides a comprehensive examination of the RISE with SAP offering, moving beyond the marketing narrative to expose the critical challenges and pitfalls that await the unprepared enterprise.

The core risks are concentrated in three areas. First, the licensing model is a labyrinth. The introduction of Full Use Equivalents (FUEs)—a metric based on user authorizations rather than actual usage—can lead to dramatic cost inflation if not meticulously managed. Furthermore, the ambiguous treatment of Indirect and Digital Access for third-party systems remains a potential source of unbudgeted expenditure.

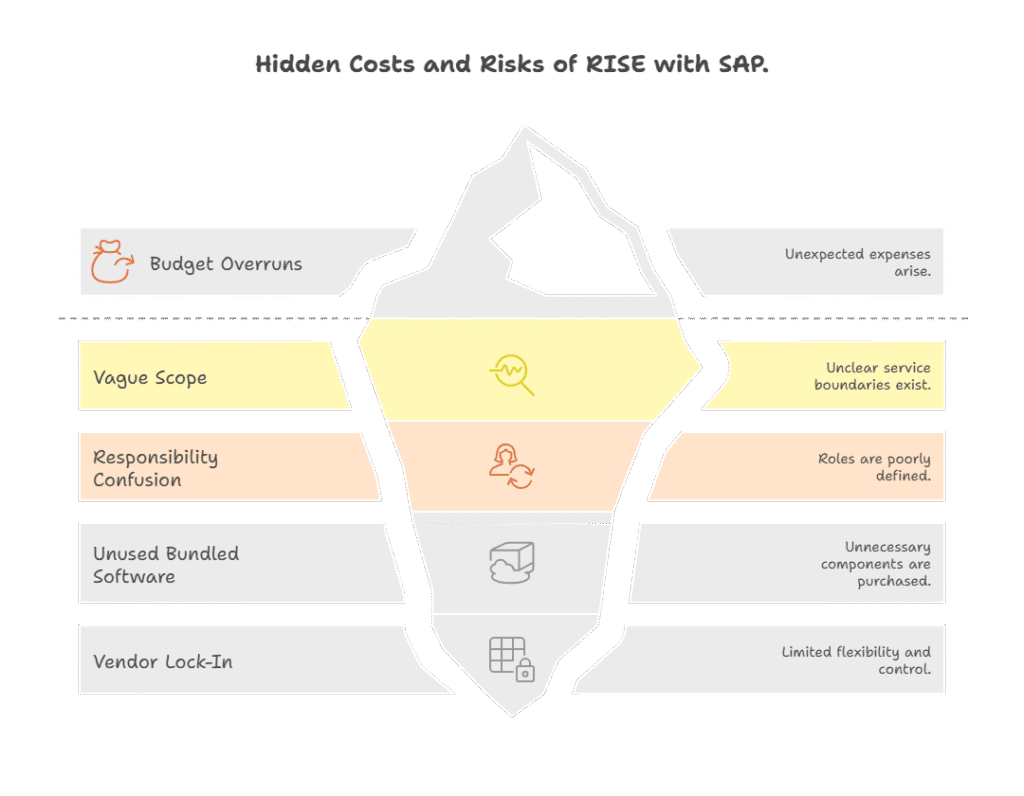

Second, the single-contract structure, while simplifying procurement, introduces significant contractual risks. Vague service scopes, confusing shared responsibility models, and a lack of cost transparency for underlying hyperscaler infrastructure can lead to budget overruns and operational gaps. The model is explicitly designed to deepen vendor lock-in, making it contractually and operationally difficult to change course once the journey has begun.

Third, implementation and migration remain fraught with peril. The promise of a smooth transition does not eliminate the fundamental challenges of data cleansing, custom code remediation, and organizational change management. Choosing the wrong migration path—be it Greenfield, Brownfield, or a hybrid approach—can jeopardize the entire business case for the transformation.

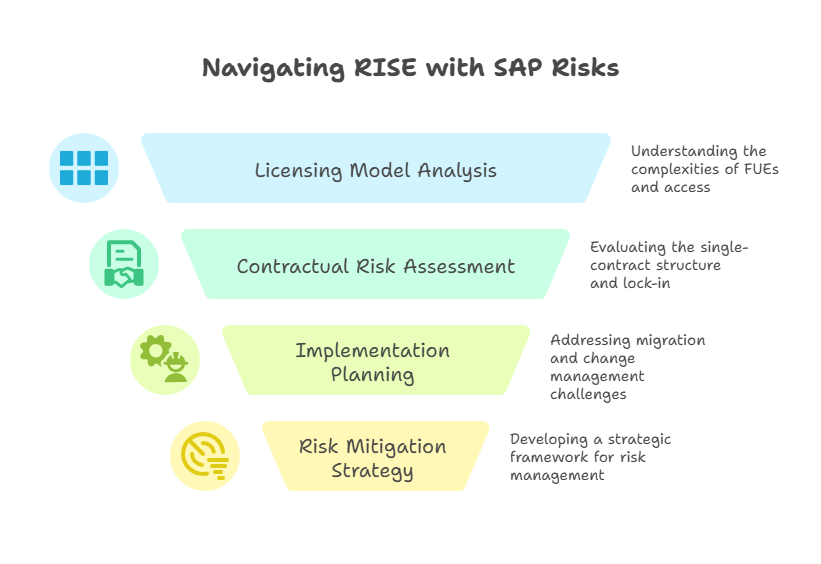

This report is designed to equip C-suite leaders with the necessary insights to navigate these challenges. It deconstructs the RISE offering, dissects its complex licensing and contractual terms, and catalogues the most common pitfalls. Most importantly, it concludes with a multi-phased strategic framework for risk mitigation. This framework provides actionable guidance for the pre-negotiation, negotiation, implementation, and post-go-live phases, enabling organizations to approach a RISE with SAP evaluation from a position of strength, clarity, and control. The ultimate goal is not to deter transformation, but to ensure it is undertaken with full visibility of the risks, empowering the enterprise to maximize value and avoid the costly surprises buried within the promise of simplicity.

Part I: Understanding the RISE with SAP Proposition

To make an informed strategic decision about RISE with SAP, it is imperative to look beyond the marketing slogans and understand the offering’s fundamental structure, its components, and the commercial drivers behind its creation. This section deconstructs the “Business Transformation as a Service” concept and provides a critical analysis of its value proposition versus the market reality.

Section 1.1: Deconstructing “Business Transformation as a Service” (BTaaS)

RISE with SAP is not a new product in the traditional sense; it is a commercial packaging of existing SAP products and services into a single, comprehensive subscription contract. The term “Business Transformation as a Service” (BTaaS) signifies SAP’s strategic shift from being a software vendor to a holistic service provider, responsible for delivering business outcomes, not just technology components. The core premise is to simplify a customer’s journey to a modern, cloud-based ERP by bundling the essential elements of software, infrastructure, and technical services under one agreement with a single Service Level Agreement (SLA).

This bundled offering is designed to provide a guided, step-by-step path for digital transformation, enabling customers to modernize their operations and infrastructure at their own pace. SAP positions itself as the single point of contact responsible for operations and support, even when the underlying cloud infrastructure is provided by a “hyperscaler” partner such as Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform (GCP).

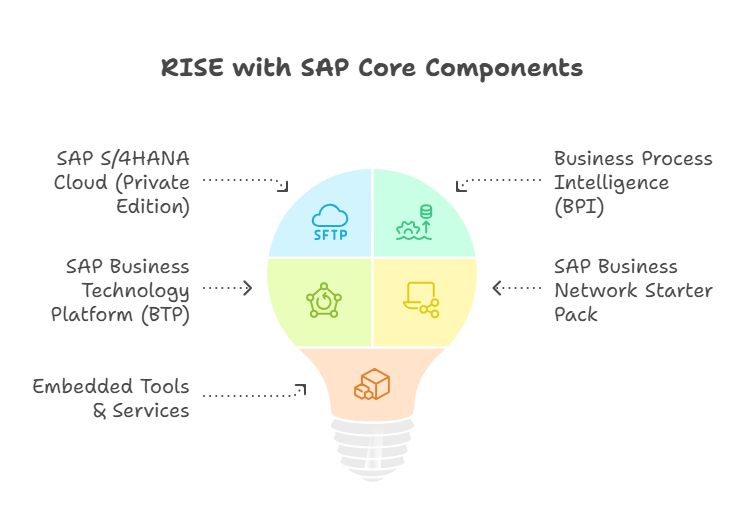

The standard RISE with SAP package is built upon five core components that work in concert to facilitate this transformation.

- SAP S/4HANA Cloud: This is the centerpiece of the offering, serving as the modern, intelligent ERP system. RISE with SAP primarily leverages the

SAP S/4HANA Cloud, Private Edition. This version provides the full functional scope of S/4HANA in a dedicated, single-tenant cloud environment. It offers greater flexibility and customization capabilities compared to the multi-tenant Public Edition, making it the more common choice for existing, complex SAP customers transitioning to the cloud. This allows organizations to retain more of their existing configurations and processes while still gaining the benefits of a cloud operating model.

- Business Process Intelligence (BPI): SAP includes tools from its acquisition of Signavio to help organizations analyze, understand, and redesign their business processes. The BPI component allows companies to benchmark their current process performance against industry standards, identify inefficiencies, and simulate the impact of process changes before implementation. This is a key element of the “transformation” aspect of BTaaS, encouraging a shift from a purely technical migration to a business-led process optimization initiative.

- SAP Business Technology Platform (BTP) Credits: The package includes a consumption-based credit pool for SAP’s Business Technology Platform, which is the company’s designated Platform as a Service (PaaS). BTP is the strategic tool for achieving a “clean core” ERP. Instead of heavily modifying the S/4HANA system itself, customers are encouraged to build custom extensions, applications, and integrations on BTP. This approach is intended to simplify future upgrades and maintain the integrity of the core ERP system.

- SAP Business Network Starter Pack: To foster digital collaboration across the supply chain, RISE includes a starter pack for the SAP Business Network. This provides initial connectivity to networks like the Ariba Network (for procurement), the Asset Intelligence Network, and the Logistics Business Network. The goal is to enable customers to connect and transact digitally with their suppliers, carriers, and other trading partners more efficiently.

- Embedded Tools and Services: The offering is rounded out with a collection of tools and services designed to facilitate the migration itself. This includes readiness checks to assess the existing landscape, access to SAP Learning Hub for training, and tools to support the technical data migration process to S/4HANA Cloud.

The bundling of these components is a deliberate strategy. By including credits for BTP and starter access to its Business Networks, SAP creates a powerful incentive for customers to build deeper dependencies on its proprietary platforms. Every extension built on BTP and every supplier connected through the Ariba Network makes it incrementally more difficult and costly for an organization to consider best-of-breed alternatives or switch platforms in the future. The “value-add” components of the bundle are, therefore, also a highly effective mechanism for creating long-term dependency and strengthening vendor lock-in.

Section 1.2: The Value Proposition vs. The Commercial Reality

SAP presents RISE with a compelling value proposition centered on simplification, cost reduction, and accelerated innovation. However, a critical analysis reveals a set of underlying commercial drivers for SAP that organizations must understand to accurately assess the offering.

The Stated Value Proposition (The “Pros”) The benefits promoted by SAP are attractive to any enterprise grappling with digital transformation :

- Simplified Vendor Management: The most prominent benefit is the consolidation of multiple contracts and vendors into one. With a single contract covering software, infrastructure, and technical management, organizations can significantly reduce the overhead associated with negotiating and managing separate agreements with software vendors, hosting providers, and managed service firms. SAP becomes the single point of contact and accountability.

- Potentially Lower Total Cost of Ownership (TCO): SAP claims that RISE can reduce TCO by up to 20% compared to a traditional on-premise S/4HANA implementation. This is attributed to eliminating the need for upfront infrastructure investment, optimizing resource utilization in the cloud, and reducing internal IT support costs.

- Accelerated Innovation and Increased Agility: By outsourcing the technical management of the ERP stack to SAP, internal IT teams are freed from tactical, “keep-the-lights-on” activities. This allows them to refocus on strategic initiatives that drive business value, such as process innovation and adopting new technologies like AI and advanced analytics more quickly.

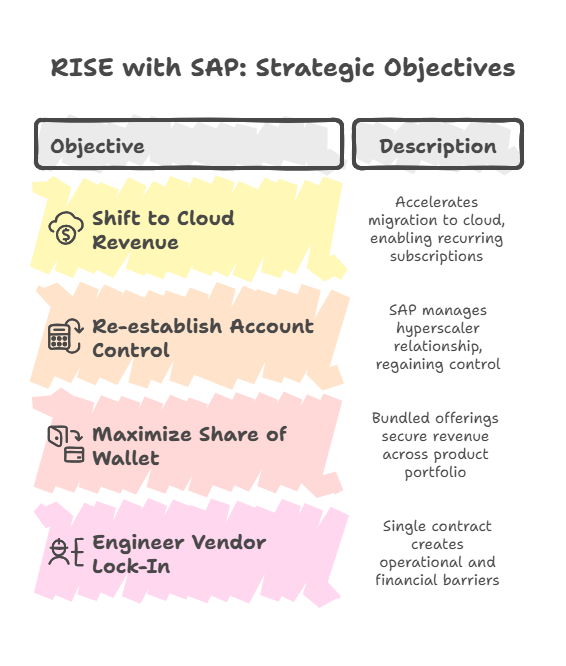

The Underlying Commercial Drivers (The Reality) While the customer benefits are real in certain scenarios, they are intertwined with powerful strategic objectives for SAP itself :

- Accelerating the Shift to Cloud Revenue: RISE is SAP’s primary engine for migrating its vast and lucrative on-premise customer base to the cloud. This transition is critical for meeting the market’s expectation for predictable, recurring subscription revenue, which is valued more highly by investors than one-time license sales and annual maintenance fees.

- Re-establishing Account Control: The rise of Infrastructure as a Service (IaaS) from hyperscalers like AWS and Azure had begun to marginalize SAP’s role. Customers could procure infrastructure directly and run SAP software on it, putting the hyperscaler in a powerful position. RISE reverses this trend by inserting SAP as the prime contractor who manages the hyperscaler relationship. This gives SAP ultimate control over the customer’s cloud ERP strategy and spend.

- Maximizing Share of Wallet and Displacing Competitors: The bundled nature of RISE is a potent sales strategy. By packaging BTP, BPI, and the Business Network, SAP can secure revenue for a wider portfolio of its products within a single, high-value deal. This makes it more difficult for customers to choose best-of-breed solutions from competing vendors in areas like process mining, integration platforms, or procurement networks.

- Engineering Deeper Vendor Lock-In: The single contract that binds software, infrastructure, and technical services together creates a powerful form of vendor lock-in. Once an organization commits to RISE, unbundling these components or moving to an alternative provider becomes operationally, contractually, and financially prohibitive.

The “simplicity” of the single contract is, therefore, a double-edged sword. While it simplifies the initial procurement process, it creates significant downstream complexity and shifts negotiating leverage firmly in SAP’s favor. The lack of transparency into the costs of the individual bundled components makes it difficult to assess value, and the all-or-nothing nature of the contract limits future flexibility. The primary beneficiary of this “simplification” is arguably SAP’s long-term account control and revenue predictability, not necessarily the customer’s agility or cost efficiency. This dynamic is central to understanding the strategic risks of a RISE commitment.

Part II: The S/4HANA Licensing Labyrinth in the Cloud

The transition to RISE with SAP entails a fundamental and often irreversible shift in how an organization licenses and pays for its core ERP software. This section dissects the new subscription-based model, explains the critical Full Use Equivalent (FUE) metric, and analyzes the persistent and complex challenge of licensing for indirect and digital access.

Section 2.1: Perpetual vs. Subscription: The Fundamental Shift

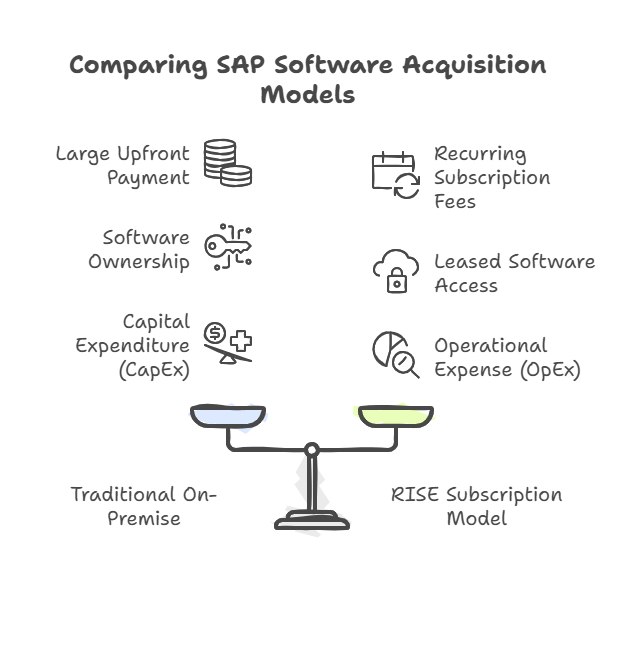

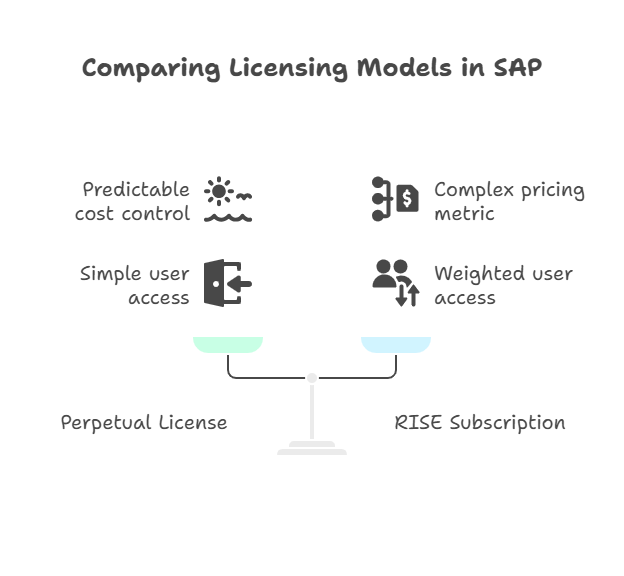

The most significant change introduced by RISE with SAP is the move away from the traditional perpetual license model to a mandatory subscription model. Understanding the financial and operational implications of this shift is paramount for any organization considering the offering.

- The Traditional On-Premise Model: For decades, SAP software was acquired through a perpetual license. This involved a large, one-time upfront payment classified as a capital expenditure (CapEx), which granted the organization the right to use the software indefinitely. In addition to this purchase, customers paid a separate annual maintenance fee—typically 20-22% of the net license cost—as an operational expense (OpEx) to receive technical support and software updates. Under this model, the software was a tangible asset on the company’s books.

- The RISE Subscription Model: RISE with SAP operates exclusively on a subscription basis. Customers pay a recurring fee, usually annually, which is treated entirely as OpEx. This subscription fee is a bundled charge that includes the right to use the S/4HANA software, the underlying cloud infrastructure from a hyperscaler, and basic technical management and support services. Critically, the customer does not own the software; they are effectively leasing it. If the subscription payments cease, the right to access and use the system is terminated.

The financial implications of this transition are profound. While the subscription model avoids a large upfront CapEx outlay, which can be attractive from a cash-flow perspective, the cumulative cost over a typical contract term (3-5 years) and beyond can significantly exceed the TCO of the perpetual model, especially when the initial license asset has been fully depreciated.

Perhaps the most critical aspect of this shift is its finality. As part of the move to RISE, existing customers are typically required to perform a contract conversion. They must surrender their perpetual licenses for ECC or other SAP products. In return, SAP offers a one-time “credit” that is applied as a discount against the new RISE subscription fees. This transaction is almost always irreversible. Once the perpetual licenses are relinquished, there is no straightforward path to revert to the previous on-premise model if the RISE experience proves unsatisfactory or too costly. The organization is locked into the subscription path.

This contractual maneuver represents a significant value transfer. The customer trades a permanent, owned asset (the perpetual license) for a temporary discount on what becomes a permanent, recurring liability (the subscription fee). For a CFO, understanding this exchange is crucial. The perpetual license, while requiring ongoing maintenance payments, provided a level of cost predictability and control that is lost in the subscription world, where the vendor has significant leverage at every contract renewal.

Section 2.2: Mastering Full Use Equivalents (FUEs)

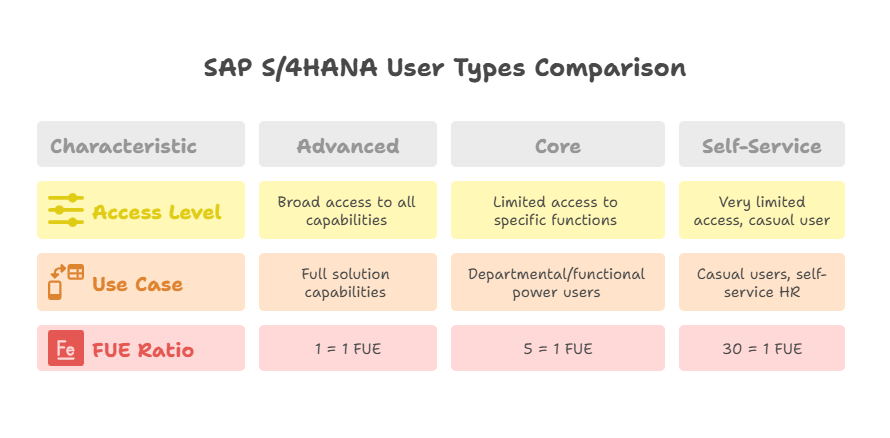

At the heart of the RISE subscription pricing is a new and complex licensing metric: the Full Use Equivalent (FUE). Moving away from a simple one-to-one named user license, the FUE model aggregates different types of user access into a single, weighted metric that ultimately determines the subscription cost.

The FUE concept works by assigning different weights to various user classifications based on their level of access to the system’s functionality. The official ratios are as follows :

- SAP S/4HANA for advanced use: This is the highest level of access, equivalent to the former “Professional Use” license, granting broad permissions to use all solution capabilities. 1 advanced user equals 1 FUE.

- SAP S/4HANA for core use: This is for departmental or functional power users with access to a more limited set of capabilities, similar to the old “Functional Use” license. 5 core users equal 1 FUE.

- SAP S/4HANA for self-service use: This is for casual users with very limited access, such as employees using self-service HR functions. This corresponds to the former “Productivity Use” license. 30 self-service users equal 1 FUE.

An organization’s total required FUE count is calculated by summing the FUE values of all its users. For example, a company with 100 advanced users (100 FUEs), 500 core users (100 FUEs), and 3,000 self-service users (100 FUEs) would need to subscribe to a total of 300 FUEs.

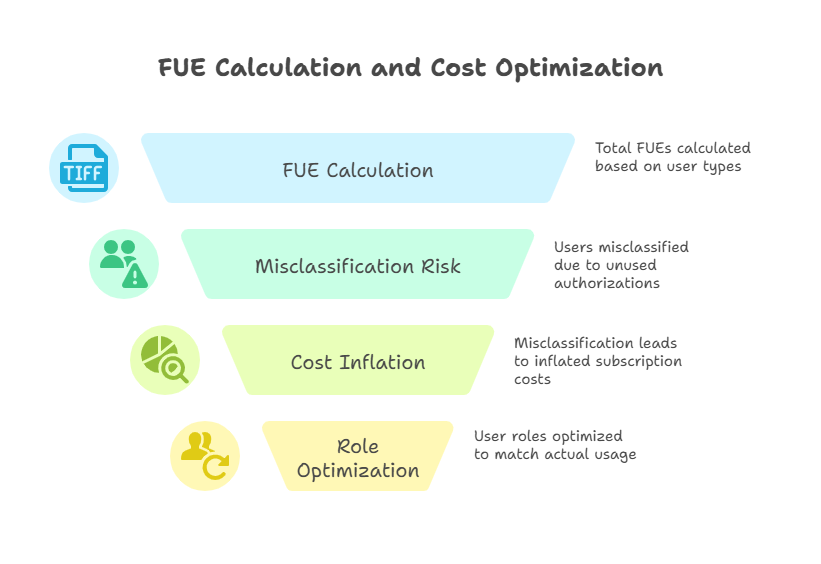

The most significant risk in this model lies in a critical detail: FUE classification is based on the technical authorizations assigned to a user profile, not on the user’s actual day-to-day activities. This creates a costly trap. A user who only performs self-service tasks but has been assigned a powerful role with extensive, unused authorizations (a common issue in poorly governed systems) will be classified as an “advanced use” user. This single misclassification would count as 1 FUE, making that user 30 times more expensive than their actual usage warrants.

This dynamic effectively weaponizes an organization’s internal governance weaknesses into a direct revenue stream for SAP. Years of “authorization creep,” where users accumulate unnecessary permissions, will translate directly into an inflated FUE count and a significantly higher subscription bill. Consequently, one of the most crucial prerequisites for a cost-effective RISE migration is to conduct a thorough audit and optimization of user roles and authorizations

before entering into contract negotiations. Failing to “right-size” user profiles prior to the FUE calculation means an organization will be paying a permanent premium for its historical lack of security and role management discipline.

Section 2.3: The Critical Frontier of Indirect & Digital Access

Indirect access—the scenario where non-SAP applications, third-party systems, or automated bots access data or trigger processes within the SAP system—has long been one of the most contentious and financially risky areas of SAP licensing. With RISE, SAP has attempted to clarify this issue through its Digital Access model, but significant risks and complexities remain.

The Digital Access model shifts the licensing focus away from the external user or system and onto the outcome of the interaction. Specifically, it licenses the creation of nine specific types of business documents within S/4HANA by an external, non-SAP interface. These documents include sales orders, purchase orders, invoices, and manufacturing orders, among others. Reading or viewing data from SAP (termed “Indirect Static Read”) does not require a Digital Access license.

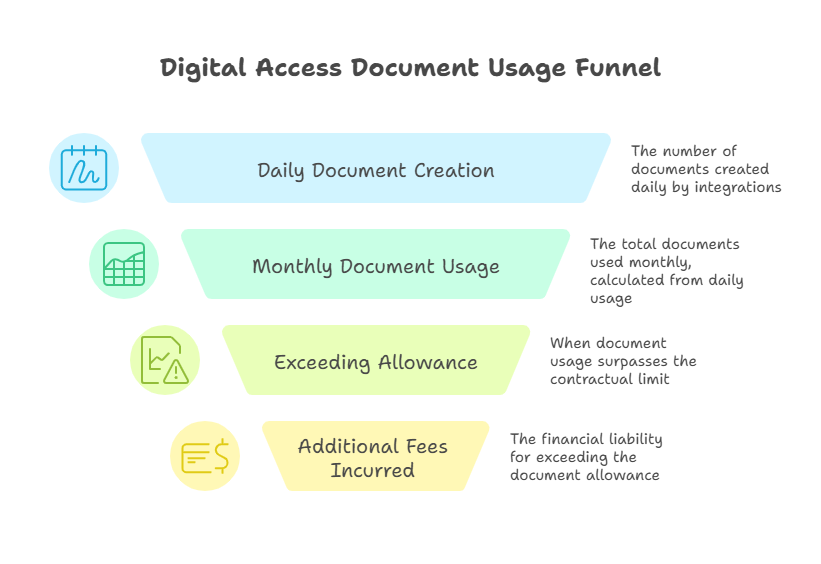

In the context of RISE, the handling of Digital Access is a frequent point of confusion and contractual ambiguity. Most standard RISE contracts do not provide unlimited, all-inclusive coverage for indirect usage. Instead, they typically bundle a predefined allowance of digital access documents into the subscription. This allowance may be generous, but it is finite. Organizations with high-volume integrations—such as a customer-facing e-commerce platform creating thousands of sales orders per day, or IoT sensors generating millions of material documents—can easily exceed these contractual limits. When the allowance is surpassed, the organization is liable for additional fees, which can be a significant and unbudgeted expense.

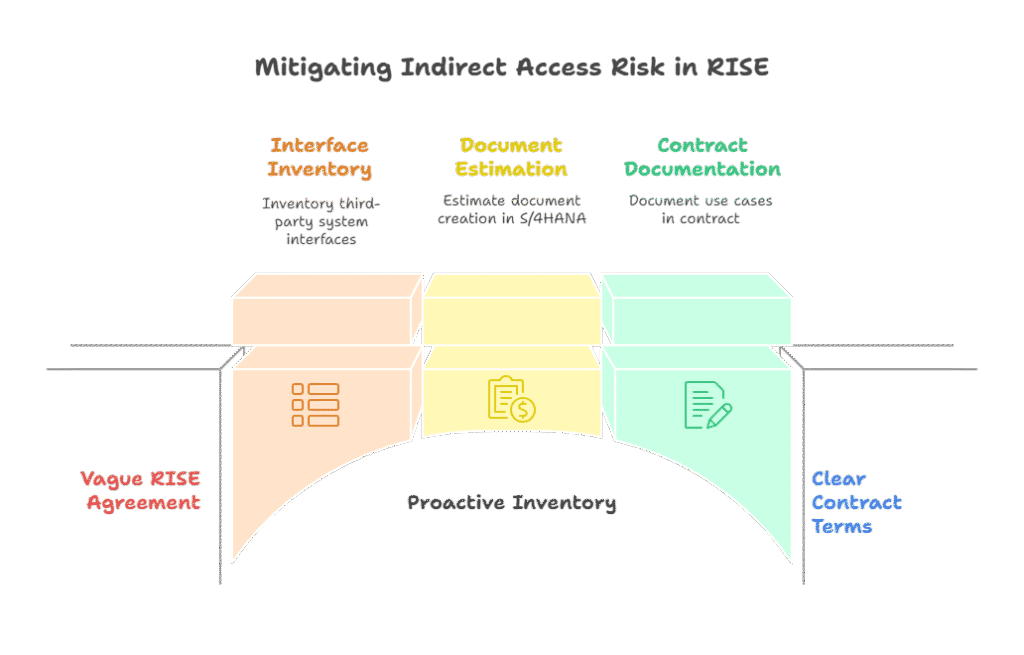

The risk is compounded by the fact that the scope of this included allowance is often vaguely defined in the standard RISE agreement. To mitigate this, it is essential for an organization to proactively perform a comprehensive inventory of all its third-party system interfaces before signing a contract. This inventory must include an estimation of the number and type of documents each system is expected to create in S/4HANA annually. These specific use cases and volume forecasts must then be explicitly documented and covered within the final RISE contract to prevent future compliance disputes and financial shocks.

This evolution of the indirect access model represents a fundamental shift in the nature of the risk for the customer. The old model was characterized by compliance risk—the fear of a punitive SAP audit uncovering unlicensed usage. The new model within RISE is one of forecasting risk. The burden is now on the customer to accurately predict its digital transaction volumes over the entire contract term. Underestimating this volume leads to costly overage charges, while overestimating it means paying for unused capacity. The challenge has morphed from a legal and compliance issue into a business intelligence and strategic planning issue, which can be equally, if not more, difficult to manage.

Part III: A Catalogue of Common Pitfalls and Strategic Risks

While RISE with SAP is marketed as a simplified path to the cloud, the journey is laden with potential pitfalls that can undermine the business case, inflate costs, and erode the value of the transformation. These risks span the contractual, financial, implementation, and operational domains.

Section 3.1: Contractual Traps and Vendor Lock-In

The single-contract model, the cornerstone of RISE’s simplicity proposition, is also the source of its most significant contractual risks. Organizations must scrutinize the agreement’s terms to avoid long-term disadvantages.

- Vague Scope of Services: A frequent and costly pitfall is the assumption that RISE is an all-inclusive, turnkey solution. Standard contracts often use broad language, leaving critical services out of scope. Enterprises later discover that essential activities like complex data migration, remediation of custom code, advanced security monitoring, functional application support, or the setup of additional non-production environments are not included in the base subscription fee and require separate, costly engagements. This discrepancy between expectation and reality can lead to significant budget overruns.

- Confusing Shared Responsibility Model: The division of labor in a cloud environment is complex. RISE operates on a shared responsibility model, typically documented in a lengthy and intricate RACI (Responsible, Accountable, Consulted, Informed) matrix. This document delineates tasks between the customer, SAP, and the underlying hyperscaler. However, if this matrix is ambiguous or incomplete, it can create dangerous operational gaps. When issues arise, particularly around security patching, performance tuning, or third-party integrations, the lack of clarity can lead to finger-pointing between parties and protracted delays in resolution.

- Bundled Shelfware: The bundled nature of RISE means customers may be forced to purchase components they are not ready to use. The inclusion of BTP credits, Business Process Intelligence tools, or Business Network starter packs can become expensive “shelfware” if the organization lacks the strategy, resources, or immediate need to leverage them. This inflates the subscription cost with little to no initial return on investment.

- Inflexibility and Deepened Vendor Lock-In: RISE contracts are typically multi-year commitments (e.g., 3-5 years) that offer very little flexibility to adjust scope or user counts downwards mid-term if business needs change. The bundling of software and infrastructure makes it nearly impossible to competitively source hosting. Furthermore, the contractual conversion from perpetual licenses to a subscription is a one-way street, with no easy path to revert. This combination of long-term commitment, bundled components, and irreversible license conversion creates a powerful vendor lock-in that significantly reduces an organization’s future negotiating leverage and strategic agility.

Section 3.2: The Financial Quicksand: Hidden Costs and TCO Illusions

The financial case for RISE can be deceptive. Beyond the headline subscription fee, a number of hidden costs and flawed assumptions can erode the promised TCO savings.

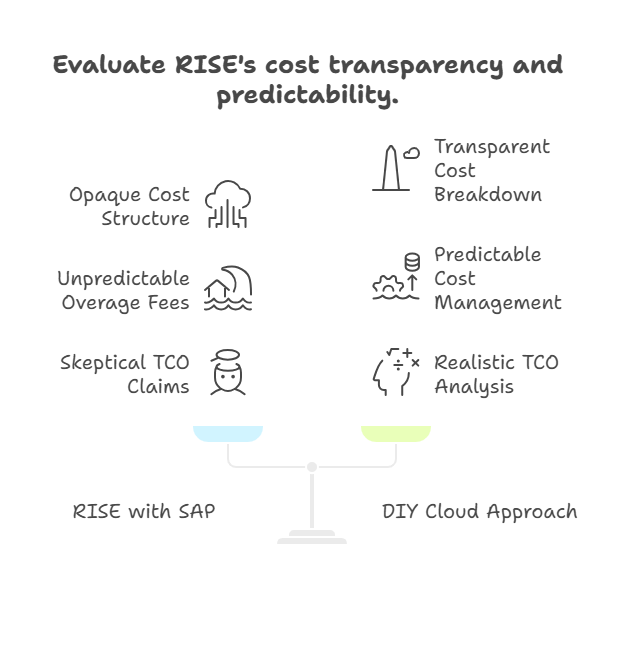

- Lack of Cost Transparency: A major drawback of the bundled model is the opacity of the underlying costs. SAP acts as a reseller for the hyperscaler’s infrastructure (AWS, Azure, GCP) but does not typically break out this cost component in the final price. This prevents customers from knowing if they are receiving a competitive market rate for the cloud resources they are consuming or if they are paying a significant premium to SAP. This lack of transparency makes it impossible to perform a true value-for-money analysis against a “do-it-yourself” cloud approach.

- Usage-Based Overage Charges: The RISE subscription is not a fixed, all-you-can-eat price. It is based on specific consumption thresholds for key metrics. Exceeding the contracted number of FUEs, the volume of Digital Access documents, data storage allocations, or CPU/RAM usage can trigger substantial and often unpredictable overage fees. Without careful monitoring and governance, these incremental charges can quickly accumulate and lead to budget shock.

- The TCO Illusion: SAP’s claim of “up to 20% lower TCO” compared to on-premise deployments must be viewed with extreme skepticism. This calculation is often based on a flawed comparison. It typically pits the RISE subscription fee against a comprehensive on-premise cost model that includes hardware, software, maintenance, and internal staffing. However, the RISE fee is not the total cost of the new solution. It excludes many significant expenses that the customer still bears, such as the fees for the system integrator (SI) partner, extensive change management and training programs, custom code remediation projects, and the internal staff required for ongoing governance and functional support. A true “apples-to-apples” analysis must compare the full “Total Cost of Transformation” for both scenarios. When all out-of-scope costs are added to the RISE subscription price, the financial advantage often diminishes or disappears entirely, particularly over a longer time horizon.

Section 3.3: Implementation and Migration Perils

The technical and organizational challenges of moving to S/4HANA are not eliminated by the RISE commercial model. The implementation phase remains a high-risk endeavor.

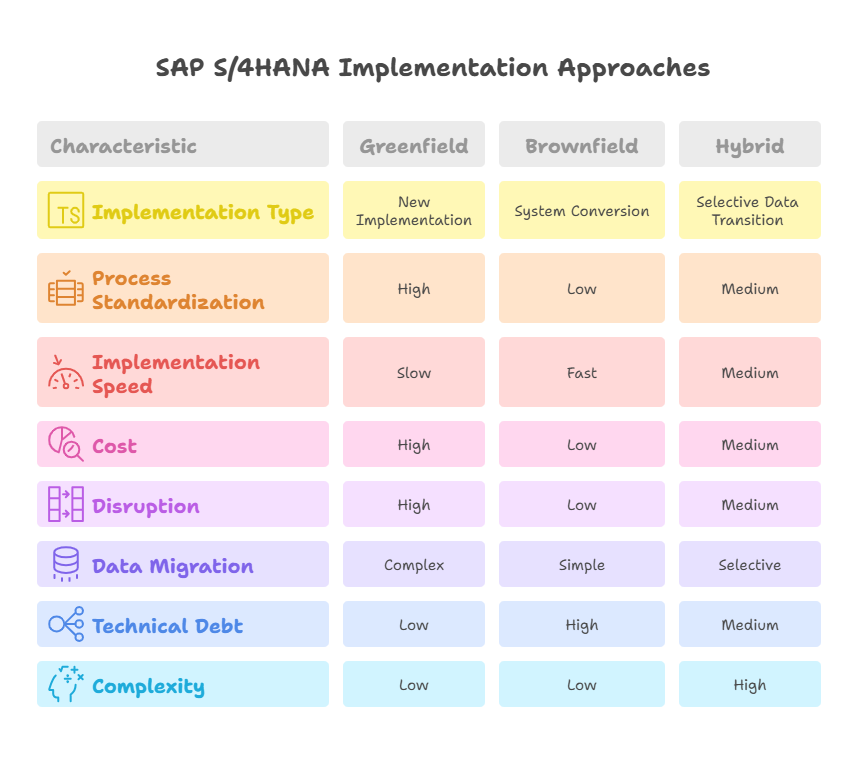

- The Migration Strategy Dilemma: Choosing the correct migration path is one of the most critical decisions of the entire project. Each approach carries a different profile of risk, cost, and potential benefit.

- Greenfield (New Implementation): This involves a complete re-implementation of SAP, starting from a clean slate. It offers the greatest opportunity to simplify and standardize processes based on best practices. However, it is the most time-consuming, expensive, and disruptive approach, and it requires migrating historical data from the legacy system, which can be complex.

- Brownfield (System Conversion): This is a technical upgrade or “lift and shift” of the existing ECC system to S/4HANA. It is the fastest, least disruptive, and most cost-effective path, and it preserves all historical data and existing processes. The major drawback is that it also carries forward all existing “technical debt,” including inefficient customizations and poor data quality, which can limit the long-term benefits of the new platform.

- Selective Data Transition (SDT) / Hybrid: This approach seeks a middle ground, combining elements of both Greenfield and Brownfield. It allows an organization to redesign certain business processes while selectively migrating necessary historical data and preserving other processes as-is. This offers a balance of innovation and continuity but is technically the most complex approach, often requiring specialized third-party tools and expertise.

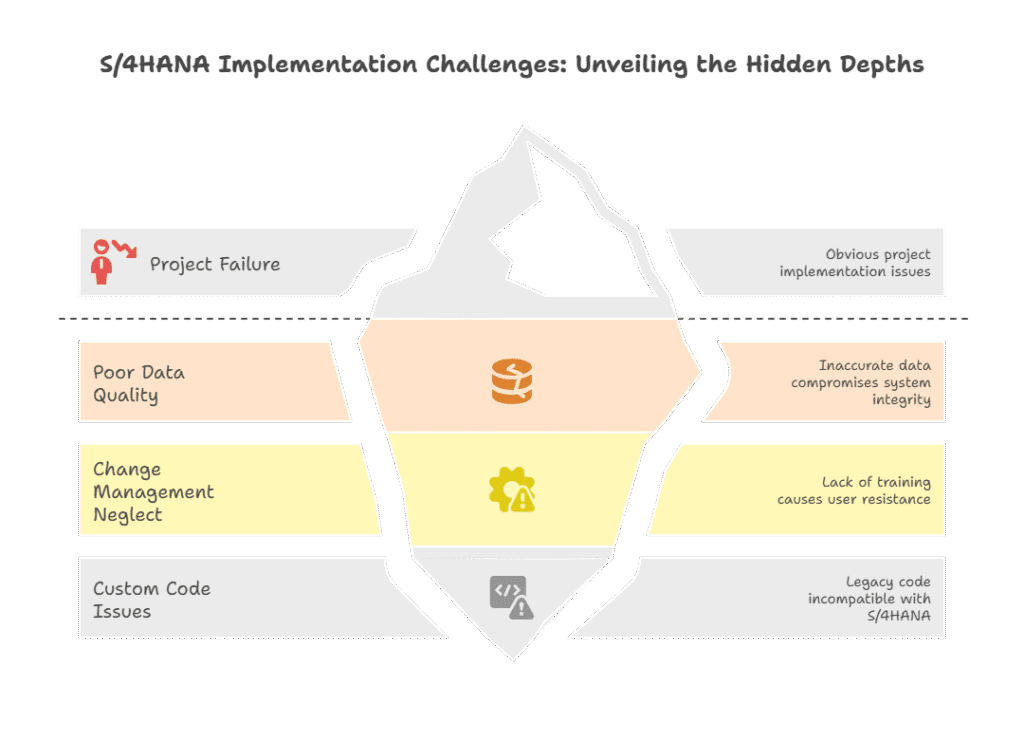

- Common Implementation Failures: Regardless of the chosen path, many S/4HANA projects are derailed by a handful of recurring issues :

- Poor Data Quality: Attempting to migrate inaccurate, incomplete, or duplicate data from legacy systems is a recipe for disaster. The new S/4HANA system’s integrity will be compromised from day one. A dedicated data cleansing and validation workstream is a non-negotiable prerequisite.

- Underestimated Change Management: The shift to S/4HANA and the new Fiori user interface represents a significant change to how users perform their daily tasks. Failing to invest in a robust organizational change management (OCM) program that includes communication, stakeholder engagement, and role-based training will result in user resistance, low adoption, and a failure to realize the project’s intended benefits.

- Custom Code and Integration Challenges: Decades of custom code (ABAP) and complex integrations in a legacy ECC system will not work natively in S/4HANA. This code must be analyzed, remediated, or retired—a significant technical undertaking that is often underestimated in initial project plans and budgets.

Section 3.4: Operational and Security Blind Spots

A common misconception is that moving to a managed service like RISE absolves the customer of their core security and operational responsibilities. This is a dangerous assumption that can lead to critical security vulnerabilities and compliance failures.

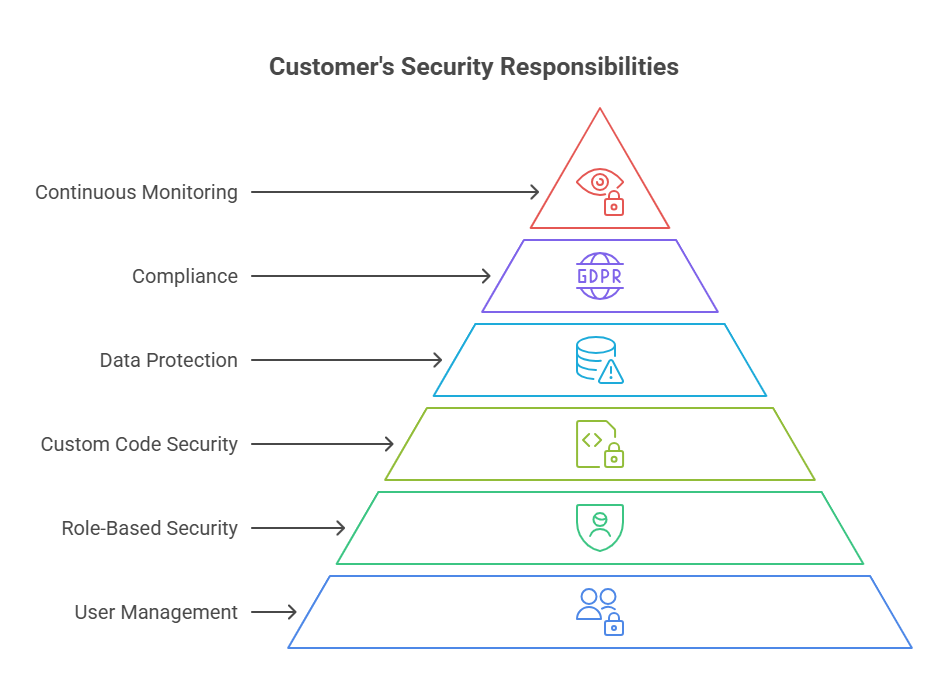

- The Shared Responsibility Model: Security in the RISE environment operates on a shared responsibility model. It is crucial to understand the line of demarcation between SAP’s duties and the customer’s ongoing obligations.

- SAP’s Responsibility (Security of the Cloud): SAP, along with its hyperscaler partner, is responsible for securing the underlying infrastructure. This includes the physical security of data centers, network security (firewalls, DDoS protection), and the security of the hypervisor, operating system, and database layers, including OS and DB patching.

- Customer’s Responsibility (Security in the Cloud): The customer retains full responsibility for everything at the application and data level. This is a substantial and non-trivial set of tasks that cannot be ignored.

The customer’s responsibilities are extensive and include managing user identities and access controls, implementing and reviewing role-based security (the principle of least privilege), securing all custom code and extensions developed on BTP, classifying and protecting all business data, and ensuring compliance with industry regulations and data privacy laws like GDPR. Furthermore, the customer is responsible for continuous security monitoring, threat detection, and auditing at the application layer. The belief that SAP is “handling security” is an illusion that can expose the organization to significant risk.

Part IV: A Framework for Risk Mitigation and Value Maximization

Successfully navigating a RISE with SAP engagement requires a proactive, multi-phased approach that begins long before any contract is signed and continues well after the system goes live. This framework provides a structured methodology for mitigating the identified risks and maximizing the potential value of the transformation.

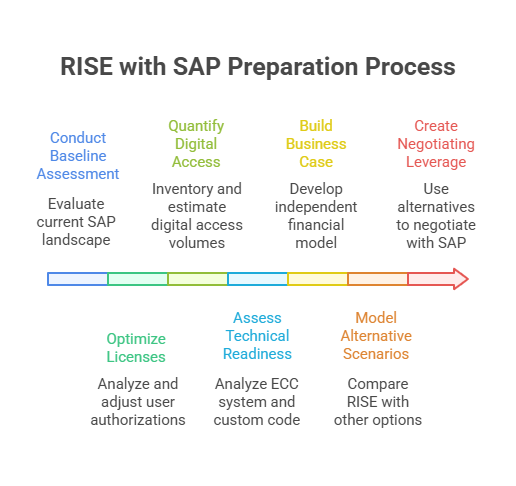

Section 4.1: Phase 1 – Pre-Negotiation Due Diligence

The most critical phase for controlling costs and reducing risk occurs before formal negotiations with SAP begin. A thorough internal assessment is essential to establish a position of strength and clarity.

- Conduct a Comprehensive Baseline Assessment: An organization must first understand its own landscape in detail.

- License and Authorization Optimization: This is the single most important preparatory step. Use specialized tools and analysis to conduct a full audit of the existing SAP user base. Identify and remove dormant or duplicate user accounts. Most importantly, analyze the authorizations assigned to each active user and “right-size” them to match their actual job functions. This process of aligning authorizations with real usage will establish an optimized, data-driven baseline for the FUE calculation, potentially reducing the required FUE count by 20% or more and generating massive subscription cost savings.

- Digital Access Quantification: Create a complete inventory of all third-party applications, custom portals, and system-to-system interfaces that connect to the SAP environment. For each interface, estimate the annual volume of the nine specific Digital Access document types it will create in S/4HANA. This data is non-negotiable for having an informed discussion about Digital Access licensing and ensuring the final contract provides adequate coverage.

- Technical and Custom Code Readiness: Perform a technical analysis of the existing ECC system. Use readiness check tools to identify compatibility issues and assess the volume and complexity of custom ABAP code. This will provide a realistic estimate of the effort required for code remediation, which is a major cost driver in any S/4HANA migration.

- Build a Competitive and Realistic Business Case: Do not rely on SAP’s TCO calculations or business case templates. Develop an independent financial model that compares RISE against credible alternatives.

- Model Alternative Scenarios: At a minimum, the business case should compare the fully loaded cost of RISE (subscription + all out-of-scope costs) against two other scenarios: 1) continuing to run the existing ECC system on-premise, potentially with lower-cost third-party support, and 2) a “do-it-yourself” cloud migration, where the organization contracts directly with a hyperscaler for IaaS and separately with a system integrator or managed service provider for implementation and support.

- Create Negotiating Leverage: Having viable, well-costed alternatives is the most powerful tool in any negotiation. It demonstrates to SAP that the organization is not a captive customer and that the RISE offering must compete on its financial and strategic merits.

Section 4.2: Phase 2 – Strategic Contract Negotiation

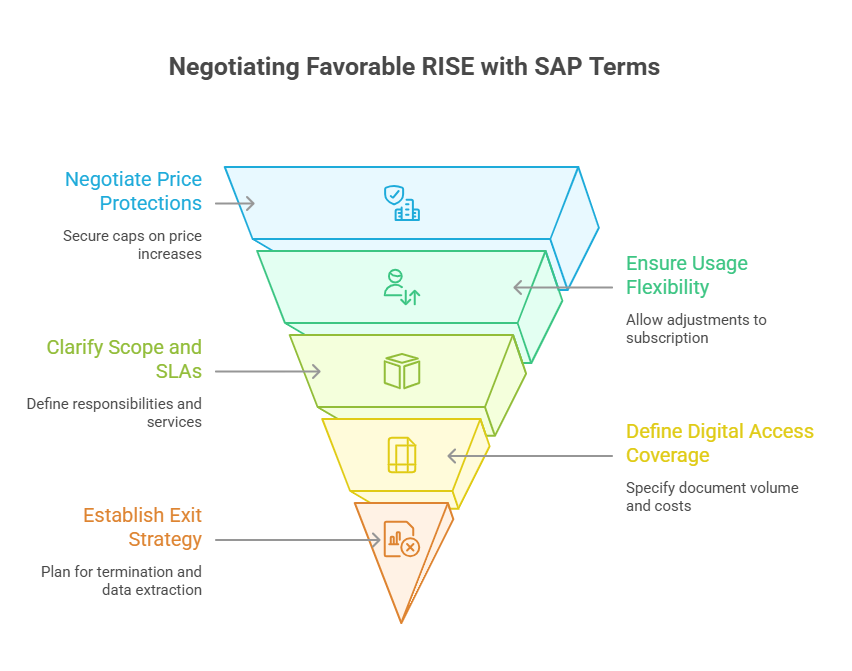

Negotiating a RISE agreement should be treated as a high-stakes strategic sourcing event, not a simple software purchase. The focus must extend far beyond the initial discount to securing favorable long-term commercial terms and contractual protections.

- Negotiate Key Commercial and Contractual Clauses:

- Price Protections: The subscription model gives the vendor immense leverage at renewal. It is critical to negotiate protections upfront. Insist on a contractual cap for any annual price escalators during the initial term and, more importantly, a cap on the price increase that can be applied at renewal (e.g., tied to a consumer price index or a fixed percentage).

- Usage Flexibility: Business is not static. Negotiate clauses that provide flexibility to adjust the subscription. This should include rights to scale FUE counts or other services down as well as up at annual review points, and the right to swap unused products (e.g., BTP credits) for other services of equivalent value.

- Scope, SLA, and Responsibility Clarity: Do not accept vague language. Insist that the contract includes a detailed Statement of Work (SOW) and a granular RACI matrix. All included environments, resource allocations, and support services must be explicitly listed. Define Service Level Agreements (SLAs) that go beyond basic system uptime to include metrics for key items like incident response and resolution times.

- Explicit Digital Access Coverage: The quantified Digital Access requirements from the due diligence phase must be written into the contract. The agreement should state the included volume of documents and the pre-agreed, fixed price for any overages.

- A Clear Exit Strategy: While difficult to obtain, an organization should always negotiate for a defined exit path. This includes clauses detailing termination assistance, the format and cost of data extraction upon contract end, and any potential rights or costs associated with converting the cloud subscription back to perpetual licenses if the relationship is terminated.

- Leverage Timing and Independent Expertise: Do not allow SAP to dictate the timeline. Avoid end-of-quarter or end-of-year deadlines, as these are artificial pressure tactics designed to rush a decision. Throughout the process, engage independent third-party licensing advisors and legal counsel who specialize in SAP contracts. Their market knowledge, benchmark data, and experience with SAP’s tactics can be invaluable in identifying hidden risks and securing a more favorable outcome.

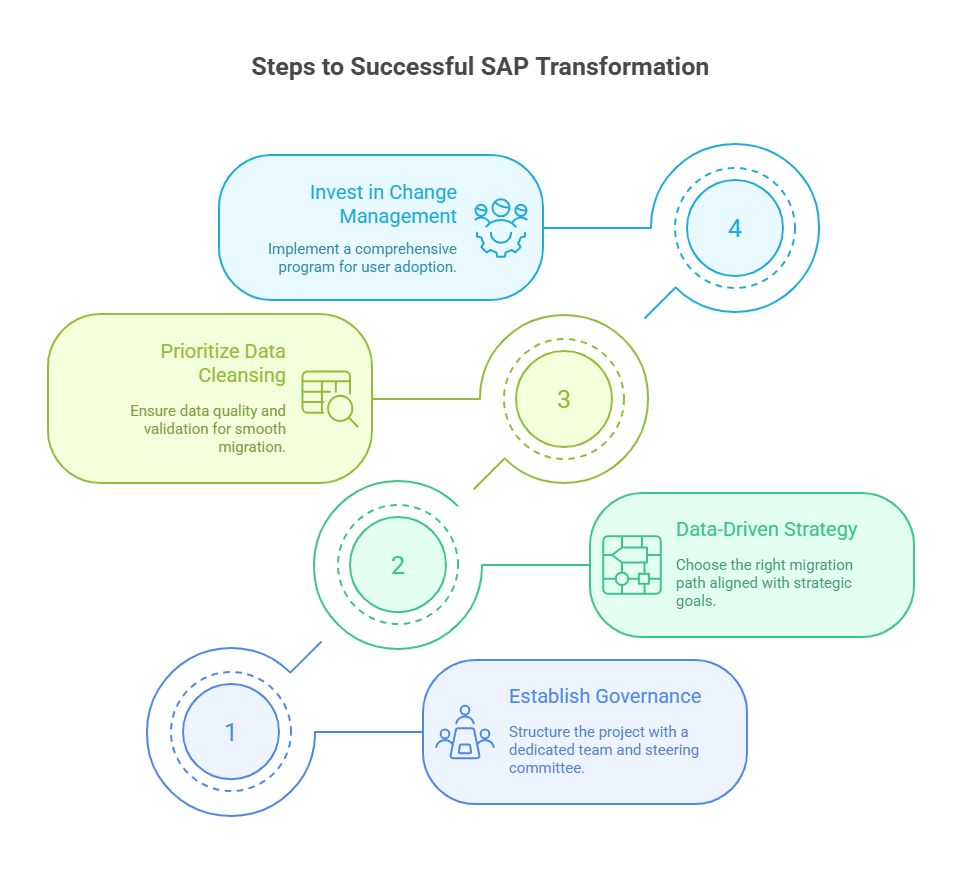

Section 4.3: Phase 3 – De-Risking Implementation and Migration

With a well-negotiated contract in place, the focus shifts to executing the transformation project successfully. Strong governance and a relentless focus on business adoption are key.

- Establish Robust Project Governance: The project must be structured for success from the outset. Appoint a dedicated and experienced internal project manager. Establish a cross-functional steering committee that includes executive sponsors from both business and IT. Crucially, the project must be framed and run as a business transformation initiative, led by the business, not as a purely technical IT upgrade. Business process owners must be empowered and accountable for the design and adoption of new processes.

- Make a Data-Driven Migration Strategy Decision: Using the analysis from the due diligence phase and the comparison framework (Table 3), make a conscious and well-documented decision on the most appropriate migration path—Greenfield, Brownfield, or SDT. The choice must be explicitly aligned with the organization’s strategic objectives, risk appetite, and budget.

- Prioritize Data Cleansing and Change Management: These two areas are the most common points of failure and must be treated as top priorities.

- Data: Charter a distinct and fully resourced workstream dedicated to data quality, cleansing, validation, and migration. This process should begin as early as possible and should not be underestimated.

- Change: Invest heavily in a structured Organizational Change Management (OCM) program. This is not just “training.” It is a comprehensive effort that includes stakeholder analysis, impact assessments, a multi-channel communication plan, and role-based training programs designed to build user competency and confidence. The goal is to drive enthusiastic adoption of the new system and processes, which is the only way to realize the project’s intended ROI.

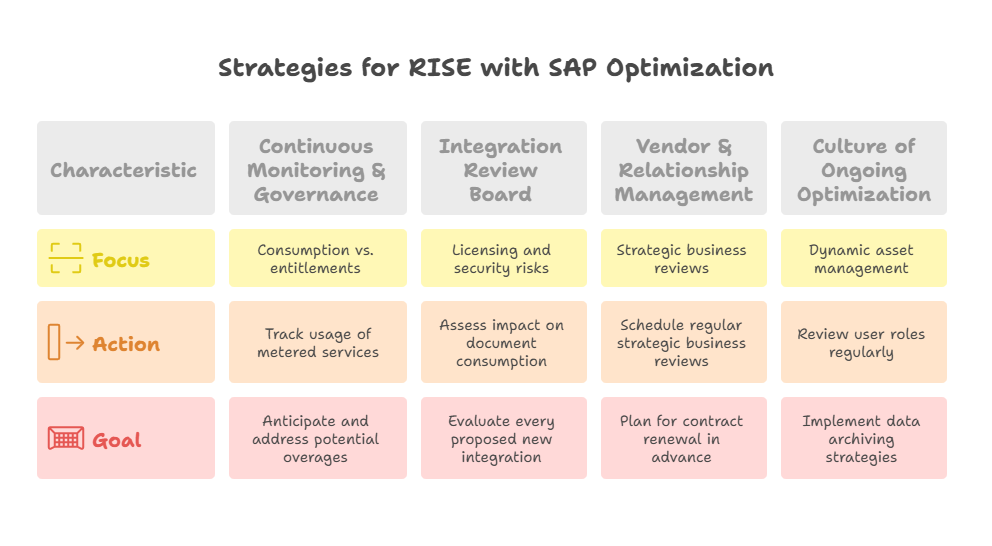

Section 4.4: Phase 4 – Post-Go-Live Governance and Optimization

The work does not end when the system goes live. The RISE with SAP subscription is a dynamic service that requires continuous management to control costs and ensure ongoing value delivery.

- Implement Continuous Monitoring and Governance: Establish formal processes and assign clear ownership for monitoring consumption against the contractual entitlements. This includes tracking the usage of FUEs, Digital Access documents, BTP credits, storage, and other metered services. Proactive monitoring allows the organization to anticipate and address potential overages before they become costly problems.

- Establish an Integration Review Board: Any new third-party system or custom application that needs to be integrated with the S/4HANA environment represents a potential licensing and security risk. Create a formal governance process or review board that must evaluate every proposed new integration. This review must assess the potential impact on Digital Access document consumption, FUE counts, and security posture before the integration is approved for development.

- Proactive Vendor and Relationship Management: Do not treat SAP as a passive utility provider. Schedule and conduct regular strategic business reviews to discuss performance against SLAs, align on technology roadmaps, and address any service issues. Begin planning for contract renewal at least 12-18 months in advance to allow ample time for a full review and negotiation.

- Foster a Culture of Ongoing Optimization: The live RISE environment should be managed as a dynamic asset. This involves regularly reviewing user roles and de-provisioning inactive accounts to maintain an optimized FUE count. Implement data archiving strategies to manage storage growth and control costs. Continuously evaluate the usage and value of bundled components like BTP to ensure they are not becoming shelfware. By treating the post-go-live phase as one of continuous optimization, an organization can ensure it extracts the maximum value from its significant investment over the long term.

Conclusion: RISE with SAP – A Strategic Move, If Done Right

RISE with SAP offers a bold promise: simplified transformation, accelerated innovation, and one hand to shake. But for C-suite leaders, this is more than a tech upgrade — it’s a redefinition of control, cost, and capability.

Before you commit, ensure you:

- ✅ Understand the true cost of FUE licensing – not just in user count, but in authorization design and role hygiene.

- ✅ Scrutinize contract scope and responsibilities – especially where SAP ends and hyperscalers or partners begin.

- ✅ Choose the right migration strategy – Greenfield, Brownfield, or Hybrid must fit your organizational DNA.

- ✅ Forecast digital access impact – plan for future licensing audits and indirect access scenarios.

- ✅ Secure internal alignment across IT, Finance, Procurement, and Legal – this is a business initiative, not just an IT one.

RISE can be the lift-off to an Intelligent Enterprise — but only if you approach it with strategic clarity, negotiation power, and ongoing governance.