Beyond the Hype: A C-Level Decision Framework for AWS, Azure, and GCP in 2025

The 2025 Cloud Imperative: More Than a Vendor, a Strategic Partner

The decision of which cloud infrastructure provider to select is no longer a tactical IT procurement choice. It has evolved into a foundational business strategy decision that will dictate an organization’s pace of innovation, financial efficiency, and competitive posture for the next decade. The scale and velocity of the cloud market underscore this new reality. Choosing a cloud provider is not about selecting a vendor; it is about committing to a strategic partner whose ecosystem will fundamentally shape the future of the enterprise.

The New Scale of the Cloud Economy

The sheer magnitude of the cloud infrastructure market signals its central role in the global economy. In the second quarter of 2025 alone, global enterprise spending on these services reached approximately $99 billion, placing the market on the verge of becoming a $100-billion-per-quarter industry. What makes this figure particularly remarkable is the market’s sustained growth rate. Despite its colossal size, the cloud market continues to expand by around 20-25% year-over-year, a rate that analysts forecast will remain above 20% annually for the next five years. This is not merely incremental growth; it signifies a profound and accelerating shift of the global economy’s digital foundation onto the infrastructure of a select few providers. For the C-suite, this means cloud strategy is now synonymous with corporate strategy.

The Generative AI Catalyst

The primary engine behind this new wave of hyper-growth is the enterprise adoption of Generative AI. The surge in cloud demand is explicitly driven by an explosion in AI usage, which has in turn revived traditional system migrations and fueled the expansion of cloud-native businesses. Market analysts directly credit this phenomenon for the market’s “monster growth”. The strategic conversation has fundamentally shifted from “migrating to the cloud for efficiency” to “adopting the cloud to power AI-native services”. This elevates the provider decision from a CIO/CTO concern to a CEO and Board-level imperative focused on competitive differentiation and future-proofing the business against AI-agile disruptors.

This AI-fueled boom has also introduced a new and critical C-level risk: strategic capacity shortages. The “Big Three” hyperscalers—Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP)—are investing staggering sums to meet this demand, with a collective capital expenditure of $78 billion in Q2 2025 alone. AWS projects spending over $100 billion in 2025, with Microsoft and Google planning investments in the range of $80 billion to $85 billion each. Despite this unprecedented build-out, the providers face a collective order backlog of $669 billion and have reported that demand is outstripping available capacity, with constraints on high-end GPUs expected to persist through the end of 2025. This creates a novel supply-chain risk where a company’s ability to launch a strategic AI initiative could be delayed not by budget or talent, but by the physical inability of its chosen cloud partner to provide the necessary compute capacity. Consequently, the C-level decision framework must now incorporate a provider’s supply chain prowess, its relationships with chipmakers, and its track record of building data centers at scale as a critical component of strategic risk management.

Deconstructing the Unique Value Proposition (UVP): Aligning with Your Business DNA

To make a sound strategic decision, leaders must look beyond feature lists and analyze the core identity of each provider. Their history, corporate culture, and strategic focus have created distinct ecosystems, each with a unique value proposition (UVP). The following table provides a concise overview of the competitive landscape in 2025.

Amazon Web Services (AWS): The Fortress of Scale and Breadth

As the market pioneer, launched in 2006, AWS’s value is rooted in its unmatched maturity, reliability, comprehensive service catalog, and the deepest ecosystem of partners and third-party integrations. It is the default choice for organizations prioritizing operational stability, granular control, and the broadest possible set of tools. This incumbency is reflected in its consistent market leadership, holding a dominant share of approximately 30-32%. AWS offers the most extensive portfolio with over 200 fully featured services, spanning foundational IaaS to specialized areas like IoT and robotics. Furthermore, it possesses the most extensive global footprint, having pioneered the concept of deploying at least three physically separate Availability Zones (AZs) per region to ensure high availability and resilience.

This value proposition is validated by its adoption in complex, mission-critical enterprise environments. For example, the BMW Group migrated its massive data lake to AWS to drive innovation and scale to meet global demand, demonstrating AWS’s capacity to handle vast, enterprise-scale data workloads for an established industrial leader. Similarly,

United Airlines migrated hundreds of core business applications to AWS to accelerate its pace of innovation, showcasing AWS as a trusted platform for essential operations in a highly regulated and complex industry.

Microsoft Azure: The Enterprise and Hybrid Champion

Azure’s strategic power comes from its deep and seamless integration with the Microsoft enterprise ecosystem. It is the clear strategic choice for organizations heavily invested in Microsoft technologies like Windows Server, Office 365, and Active Directory, as well as for those requiring sophisticated hybrid cloud management to bridge on-premises data centers with the public cloud. This focus has propelled Azure to a strong and growing number two position, capturing 20-23% of the market by leveraging Microsoft’s massive existing enterprise customer base.

A key technical differentiator is Azure Arc, a control plane that enables a unified management and governance layer for resources across on-premises environments, Azure, and even other clouds like AWS. This is a powerful tool for organizations navigating complex hybrid realities. Furthermore, Azure offers native connectors and significant licensing benefits, such as the

Azure Hybrid Benefit, which allows customers to use their existing on-premises Windows Server and SQL Server licenses in the cloud, providing a substantial Total Cost of Ownership (TCO) advantage.

Enterprise case studies confirm this focus. Air India transformed its customer service by building a new virtual assistant on Azure OpenAI Service, which now handles 97% of queries automatically and saves millions in support costs. This highlights Azure’s strength in deploying enterprise-grade AI as a packaged solution to solve specific business problems. In another example, the Spanish football league

LALIGA reimagined fan engagement by using Azure Machine Learning at a massive scale, demonstrating Azure’s capability to power data-intensive applications for major global brands.

Google Cloud Platform (GCP): The Engine for Data-Driven Innovation

Built on the same planet-scale infrastructure that powers Google Search and YouTube, GCP’s value proposition is its superiority in data analytics, AI/ML, and cloud-native, container-based application development. It is the preferred platform for companies looking to build disruptive, data-intensive products and leverage cutting-edge artificial intelligence. This focus has allowed GCP to become a fast-growing number three player with 11-13% market share, demonstrating strong momentum, particularly in deals driven by AI workloads.

GCP’s technical differentiation is clear, with industry-leading services like BigQuery, a serverless and highly scalable data warehouse; Vertex AI, a unified platform for building and deploying ML models; and Google Kubernetes Engine (GKE), widely considered the gold standard for container orchestration. Its high-speed private global fiber network also provides a tangible performance edge for data-intensive applications.

The platform’s power is proven by its adoption by digital-native giants. PayPal migrated mission-critical workloads to GCP to handle immense transaction surges—processing 1,000 payments per second during peak holiday periods—and to leverage its advanced data analytics, proving GCP can operate at extreme scale and performance for the demanding financial services industry. Similarly,

The Home Depot migrated its entire enterprise data warehouse from a legacy on-premises system to BigQuery. This allowed its data estate to grow from 450 terabytes to over 15 petabytes and enabled real-time analytics that were previously impossible, driving better inventory management and a more personalized customer experience.

These distinct value propositions are not static; they function as self-reinforcing strategic flywheels. Azure’s deep integration with Microsoft’s software suite gives it a captive enterprise audience. This generates revenue and usage data that informs the development of more enterprise-focused features like Azure Arc, which in turn makes Azure an even more compelling choice for its target market, creating a powerful cycle. Likewise, GCP’s excellence in AI and data attracts the most demanding AI startups and data-driven enterprises. These customers push the platform to its limits, driving innovations like custom AI chips (TPUs) and more powerful versions of BigQuery. This innovation cements GCP’s reputation as the “AI cloud,” attracting even more AI-focused customers. These enterprise case studies are not just marketing material; they are tangible proof of each provider’s problem-solving DNA. The Home Depot chose GCP specifically for BigQuery to solve a petabyte-scale data problem—a data-centric challenge solved by a data-centric provider. An executive can use these examples as a litmus test: if a company’s core strategic challenges mirror those solved in a provider’s flagship case studies, it is a strong indicator of strategic alignment.

An Executive’s Guide to Total Cost of Ownership (TCO)

A strategic analysis of TCO requires moving beyond headline prices to understand the nuances of pricing models, hidden costs, and the financial impact of different discount structures. Cloud cost is not a single line item but a complex equation influenced by compute, storage, networking, and operational overhead.

The Three Pillars of Cloud Cost: Compute, Storage, and Networking

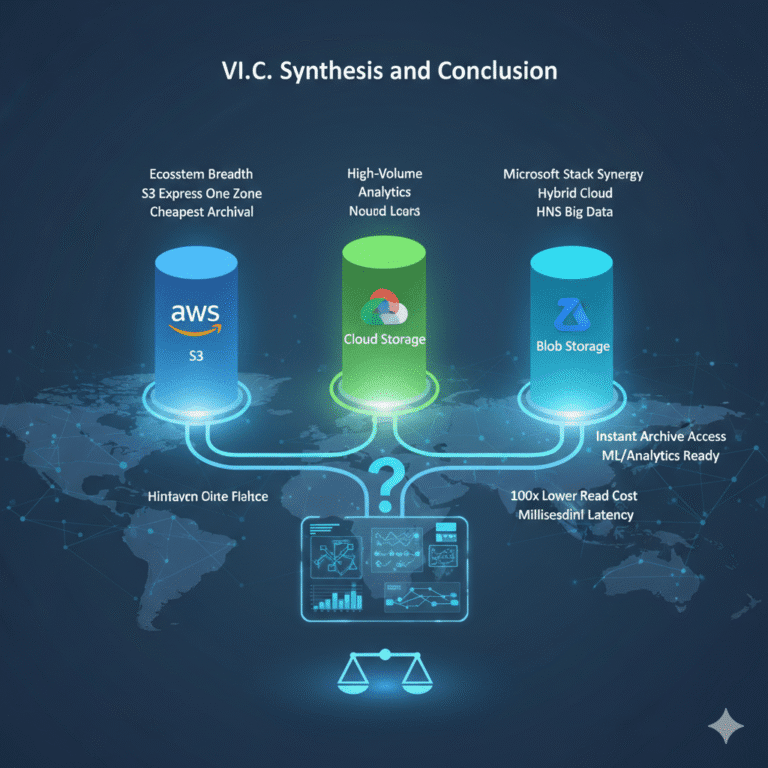

Compute Cost Analysis: For on-demand virtual machines, AWS and Azure are highly price-competitive, while GCP is often marginally more expensive. However, when long-term commitments are factored in, a clear leader emerges. For both 1- and 3-year commitments, AWS consistently offers the lowest prices for compute, with the savings becoming more significant at larger scales.

Storage Cost Analysis: In the realm of object storage, the competitive landscape is inverted. Across multiple regions and storage volumes (from 10 TB to 500 TB), Azure is consistently the most cost-effective option, while AWS is the most expensive.

Networking Cost Analysis: A critical and often overlooked component of TCO is the cost of moving data. Data egress, or data transferred out of the cloud to the public internet, is a significant potential expense. Providers typically charge around $0.085 to $0.09 per GB after an initial free tier, a cost that can accumulate rapidly for data-heavy applications.

Unlocking Value: A Strategic Comparison of Discount Models

The most significant TCO optimizations come from aligning workload patterns with the appropriate discount models. Each provider offers a distinct portfolio of options:

- Commitment-Based Discounts: AWS (Reserved Instances, Savings Plans), Azure (Reservations), and GCP (Committed Use Discounts) all offer deep discounts of up to 72% for 1- or 3-year commitments on predictable workloads. These are best suited for mature organizations with stable usage patterns and sophisticated financial planning (FinOps) capabilities.

- Automatic Discounts (GCP): A key differentiator for Google Cloud is its Sustained Use Discounts. This model provides automatic discounts for workloads that run for a significant portion of the month, without requiring any upfront commitment or planning. This is ideal for startups or businesses with variable but persistent workloads, as it rewards consistent usage without penalizing unpredictability.

- Spot/Preemptible Instances (All): All three providers offer their spare compute capacity at discounts of up to 90%. However, these instances can be terminated with little notice. This makes them an excellent choice for fault-tolerant, non-critical workloads like batch processing, scientific computing, or AI model training, where interruptions can be managed.

- Licensing Discounts (Azure): The Azure Hybrid Benefit is a powerful and unique TCO lever for enterprises. It allows organizations to apply their existing on-premises Windows Server and SQL Server licenses with Software Assurance to their Azure workloads, dramatically reducing software licensing costs in the cloud.

The choice of discount model is a direct reflection of an organization’s operational maturity. To confidently sign a 3-year AWS Savings Plan—the model offering the best raw compute prices—a company must have a mature FinOps team, excellent forecasting capabilities, and highly predictable workloads. A startup with unpredictable growth would be financially penalized by such a commitment and would derive far more value from GCP’s automatic Sustained Use Discounts, which require no forecasting. The “cheapest” cloud is the one whose pricing philosophy best aligns with a company’s own ability to predict its future.

The Hidden Ledger: Factoring in Indirect and Operational Costs

A comprehensive TCO analysis must extend beyond direct service costs to include indirect and operational expenses:

- Data Transfer Costs: Beyond egress to the internet, costs for transferring data between different regions or even different availability zones within the same region can be a surprise expense, particularly for globally distributed or disaster recovery architectures. These “data taxes” are a primary threat to multi-cloud TCO. An organization might pursue a “best-of-breed” multi-cloud strategy, using BigQuery on GCP for analytics and Azure for Microsoft workloads. However, if the terabytes of data analyzed in BigQuery must be moved to Azure for integration, the egress fees charged by GCP could completely erase any TCO benefits. This makes data gravity and transfer architecture a first-class C-level concern, as the decision of where to store primary datasets has profound, long-term financial implications.

- Premium Support: Enterprise-grade support is a significant and often mandatory operational expense. The cost structures for support vary, and this can be a notable line item, particularly with AWS.

- API Request Fees: Serverless functions (AWS Lambda, Azure Functions) and storage services charge for API requests. At scale, these micro-transactions can accumulate into a substantial cost.

- Talent and Training: The cost of hiring or training staff with expertise on a specific platform is a real TCO factor. The larger and more mature ecosystem of AWS often translates to a larger available talent pool, which can be a hidden TCO advantage by reducing hiring friction and salary premiums.

The Strategic Decision Framework: Choosing Your Primary Cloud Partner

There is no single “best” cloud provider. The optimal choice depends on a systematic evaluation of a provider’s strengths against an organization’s unique business context. This four-step framework is designed to guide executive decision-making.

Step 1: Align with Core Business Strategy (Cost, Agility, or Innovation)

The evaluation process must be anchored to the company’s overarching strategic driver. A simple checklist treats all criteria as equal, which is strategically flawed. By first identifying the primary driver, the subsequent evaluation becomes more focused and relevant.

- If your driver is Cost Optimization: Prioritize the provider with direct TCO advantages for your specific workload. For a Microsoft-heavy enterprise, Azure’s Hybrid Benefit is likely unbeatable. For predictable, long-term workloads with no Microsoft dependency, AWS’s 3-year Savings Plans offer the best compute pricing.

- If your driver is Business Agility: Prioritize the provider with the broadest ecosystem and most mature services. AWS’s vast service catalog and extensive partner network often allow for the fastest time-to-market for the widest range of applications.

- If your driver is Market Innovation: Prioritize the provider with the leading-edge technology in your domain. For businesses building their future on data analytics and AI, GCP’s leadership in BigQuery and Vertex AI represents a powerful strategic advantage.

Step 2: Evaluate Your Technology Stack and Talent Pool

- Microsoft-centric Organizations: The TCO and integration benefits of Azure are immense. The decision to choose another provider must be justified by a compelling, non-negotiable technical requirement, such as needing the specific capabilities of BigQuery.

- Open-Source and Cloud-Native Organizations: These businesses will find a strong cultural and technical fit with GCP, given its deep roots in open-source projects like Kubernetes and its developer-friendly tooling.

- Heterogeneous Environments: For organizations with a diverse mix of technologies, AWS’s sheer breadth and market leadership make it a versatile, “safe harbor” choice that can accommodate almost any technology stack.

- Talent Availability: Assess the local and global talent pool. AWS expertise is the most widespread, which can reduce hiring friction and costs.

Step 3: Assess Risk, Security, and Compliance Posture

While all three providers offer robust security, their philosophies and strengths differ. The choice should align with an organization’s specific security posture and regulatory needs.

- Security Model: AWS offers the deepest and most granular security controls, ideal for organizations that require meticulous configuration. Azure excels in integrating with on-premises enterprise security tools and identity systems, a key advantage for hybrid environments. GCP emphasizes “secure-by-default” configurations and innovative, AI-driven threat detection.

- Compliance and Data Sovereignty: For businesses in highly regulated industries (e.g., finance, healthcare) or those operating in regions with strict data residency laws, a provider’s global footprint and compliance certifications are paramount. With over 60 regions, Azure has the largest number of geographic locations, which can be a key advantage for meeting data sovereignty requirements.

Step 4: Future-Proofing for a Multi-Cloud World

Vendor lock-in is a primary executive concern, and a forward-looking strategy must account for a multi-cloud reality. A key evaluation criterion should be the provider’s strategy for managing distributed and multi-cloud environments. This represents a new strategic battleground, shifting from locking customers

in to managing them everywhere.

- Control Planes: The maturity and capability of Azure Arc, Google Anthos, and AWS Outposts are critical. These are not just hybrid tools; they are strategic control planes for managing a distributed, multi-cloud reality. Azure Arc, for example, can manage servers and Kubernetes clusters running on AWS or on-premises, bringing them under Azure’s governance and management umbrella. This capability shifts the decision from “Which cloud do I put my workload on?” to “Which cloud’s management plane do I use to control all my workloads?”

- Open Standards: Favoring providers that embrace open standards (like Kubernetes) and offer clear data export paths is a critical long-term risk mitigation strategy. This ensures that applications remain portable and reduces the friction of moving workloads between environments if strategic needs change.

Conclusion: Beyond a Single Choice—Forging a Partnership for the Future

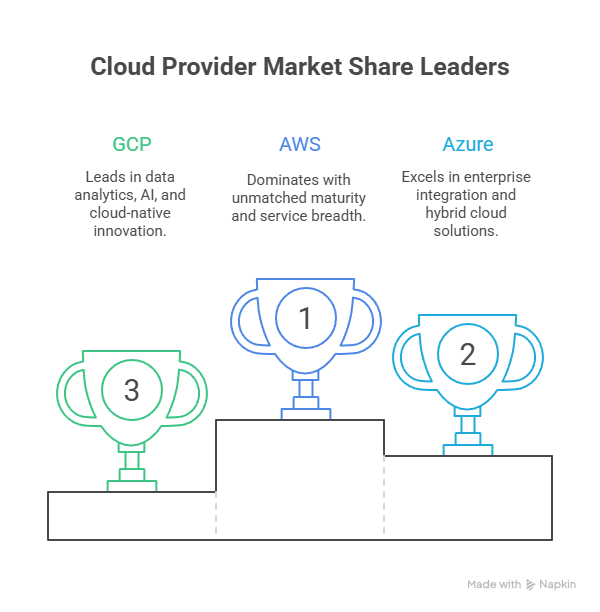

The analysis demonstrates that there is no single “best” cloud provider. The market has matured into three distinct ecosystems, each with a clear and compelling value proposition.

- AWS is the fortress of stability and breadth, the optimal choice for organizations prioritizing operational maturity, a vast toolkit, and the largest ecosystem.

- Microsoft Azure is the undisputed champion of the enterprise and hybrid cloud, offering unparalleled value and integration for organizations already invested in the Microsoft stack.

- Google Cloud is the engine of innovation, the clear leader for businesses building their competitive advantage on data, analytics, and artificial intelligence.

The decision framework provided in this report moves beyond a simple technical comparison to a strategic alignment exercise. The right choice is the provider that best matches an organization’s core business drivers, existing technology landscape, and long-term vision. The process should be deliberate and data-driven, often culminating in a hybrid or multi-cloud strategy where workloads are placed on the platform that offers the most strategic value. Ultimately, choosing a primary cloud provider is one of the most consequential decisions a leadership team will make. It is about forging a long-term strategic partnership that will serve as the cornerstone of the business for years to come.